Introduction:

In today’s fast-paced world, creating multiple streams of income has become more essential than ever. Passive income ideas provide a way to earn money with less direct involvement, allowing you to enjoy financial freedom and flexibility. Whether you’re looking to supplement your current income or achieve complete financial independence, here are 15 passive income ideas for 2023 that you can explore.

What is passive income?

Passive income is income that you earn without having to actively work for it. It can come from a variety of sources, such as rental properties, investments, or royalties. Passive income is often contrasted with active income, which is income that you earn from working a job or running a business.

There are many benefits to generating passive income. It can help you to:

- Reach financial independence.

- Reduce your reliance on a single source of income.

- Create a more secure financial future.

- Have more time and freedom to do the things you enjoy.

15 Passive Income Ideas:

Online Store:

Similar to dropshipping, an online store relies on third-party suppliers to fulfill orders. Using platforms like OrderZ, you can create an e-commerce site, list products, and when a customer makes a purchase, the supplier handles shipping and customer service.

Dividend Stocks:

Investing in dividend stocks involves purchasing shares of companies that regularly distribute a portion of their earnings to shareholders in the form of dividends. These dividends provide a steady stream of income, and the value of your investment can also appreciate over time.

Real Estate Crowdfunding:

Real estate crowdfunding platforms allow you to invest in real estate projects with a relatively small amount of capital. You can choose specific projects that align with your investment goals and earn a share of the rental income and potential property value appreciation.

Peer-to-Peer Lending:

Peer-to-peer lending platforms connect individuals looking for loans with potential lenders. By lending your money to these borrowers, you earn interest on the amount you’ve lent. This can be a way to diversify your portfolio and earn regular interest payments.

Create an Online Course:

If you have expertise in a particular field, creating and selling an online course can be lucrative. Platforms like Udemy or Teachable provide a marketplace for your course, and once created, you can continue to earn money as more students enroll.

Automated Dropshipping:

Dropshipping involves setting up an online store and partnering with suppliers who handle inventory and shipping. When customers purchase products from your store, the supplier ships the products directly to the customer, and you earn a profit on the difference between the retail price and the wholesale price.

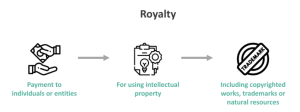

Royalties from Intellectual Property:

If you’re a creator, you can earn royalties from your intellectual property, such as books, music, or artwork. Whenever someone purchases or uses your work, you receive a portion of the revenue. This can provide ongoing income long after the initial creation.

Create a Mobile App:

Developing a mobile app can be a significant investment upfront, but once the app is launched, it can generate revenue through in-app purchases, ads, or premium versions. Regular updates and improvements can help maintain its appeal to users.

High-Yield Savings Accounts:

High-yield savings accounts offer a higher interest rate than traditional savings accounts. While the returns may not be as high as some other investment options, they provide a low-risk way to earn passive income on your cash savings.

Affiliate Marketing:

Affiliate marketing involves promoting products or services through your online platform (blog, website, social media) using unique referral links. When someone makes a purchase through your link, you earn a commission. Building a targeted audience is key to success in this field.

Invest in REITs:

Real Estate Investment Trusts (REITs) allow you to invest in a diversified portfolio of real estate properties without owning them outright. They often distribute the majority of their rental income to shareholders in the form of dividends.

Create a YouTube Channel or Podcast:

Generating income from YouTube videos or podcasts involves producing engaging content that attracts viewers or listeners. Revenue can come from ads, sponsorships, merchandise sales, and even fan support on platforms like Patreon.

License Your Photography:

If you’re a photographer, you can license your photos on stock photography websites. Whenever someone downloads your photo for use, you earn a royalty fee. This can be a way to monetize your photography portfolio.

Invest in a Business:

Becoming a silent partner in a business allows you to invest capital without actively participating in day-to-day operations. You’ll typically receive a share of the profits in return.

Automated Investing Apps:

Robo-advisors and automated investing platforms use algorithms to manage your investments. They create and maintain a diversified portfolio tailored to your risk tolerance and financial goals, all with minimal effort on your part.

These are just a few of the many passive income ideas that are available. The best passive income idea for you will depend on your skills, interests, and resources. Do some research and find an idea that you’re passionate about and that you think you can make a success of.

Here are some additional tips for generating passive income:

- Start small and scale up. Don’t try to do too much too soon. Start with one passive income stream and build from there.

- Be patient. It takes time to build a successful passive income stream. Don’t expect to get rich quick.

- Be consistent. The key to passive income is consistency. Keep working at it and you will eventually reach your goals.

Conclusion:

Generating passive income in 2023 has never been more accessible, thanks to the wide array of opportunities available.

Whether you’re interested in investing, creating digital products, or leveraging your creative skills, these 15 passive income ideas can help you achieve your financial goals while gaining more control over your time and resources.

Remember that while passive income requires initial effort and investment, the rewards can be significant in the long run. As you explore these ideas, choose the ones that align with your interests, skills, and risk tolerance for the best chance of success.

FAQs

- What is passive income?

Passive income is money earned with minimal ongoing effort or active involvement. It’s income that continues to be generated even when you’re not actively working on a task or project.

- How is passive income different from earned income?

Earned income is the money you receive in exchange for your time and skills, typically from a job or active business. Passive income, on the other hand, is generated from investments, assets, or ventures that you’ve set up and require less day-to-day involvement.

- What are some examples of passive income sources?

Examples of passive income sources include rental income from real estate, dividends from stocks, interest from savings accounts, royalties from creative works like books or music, and earnings from automated online businesses.

- Do passive income streams require upfront work?

Yes, many passive income sources require upfront effort, such as creating an online course, investing in stocks, or setting up a rental property. The initial work is an investment that can lead to ongoing income in the future.

- Is passive income truly “hands-off”?

While passive income is designed to require less ongoing effort compared to traditional earned income, most passive income streams still need some level of monitoring, maintenance, and occasional decision-making to ensure they continue to perform well.